Keep It Simple, Stupid

Bernie Madoff promised high returns with low risk through all market cycles, but it was all built on a lie.

When the Columbia space shuttle took off in January 2003 chunks of insulation foam were observed breaking off and hitting the underside of one of the wings. If the underside of the wing had been damaged, there was a high chance that the shuttle wouldn’t be able to withstand the immense heat on re-entry to the earth’s atmosphere, leading to disintegration of the shuttle.

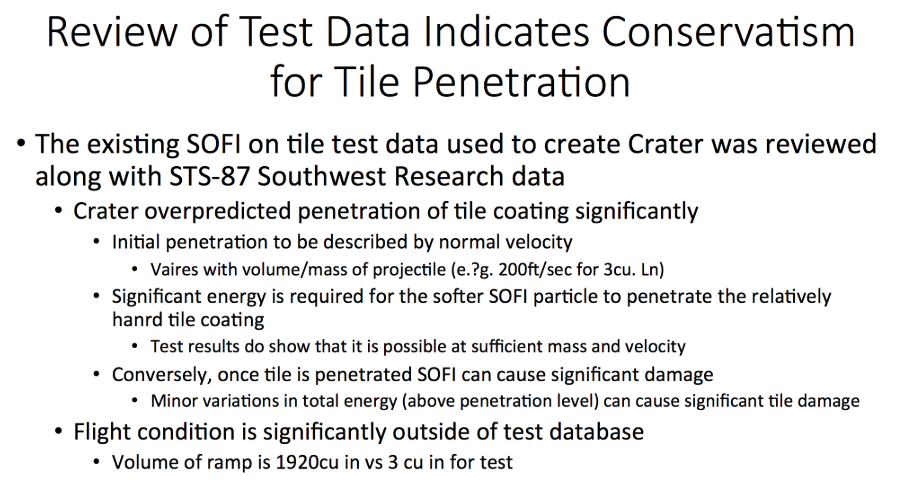

While the crew spent two weeks orbiting the earth, engineers prepared a PowerPoint presentation setting out their analysis of the situation. Below is the now infamous slide that summarised their findings. The engineers felt that they had correctly communicated the risks to NASA. The NASA officials felt that the engineers didn’t really know what would happen, but that on balance the risk to the crew was very low.

Sadly, Columbia was destroyed on re-entry, killing all seven crew members.

Edward Tufte, a professor at Yale University and an expert in communications, analysed the NASA presentation and made several observations.

The heading gave undue prominence to an unfounded and misleading conclusion that suggested little or no risk.

The reader had no idea whether the four bullet points were in order of importance or are all equal importance, leaving NASA to give unwarranted relevance to the first bullet point.

Tufte also pointed out that the amount of information, at well over 100 words, the vagueness of some of the terms, and the use of different words that mean the same thing, would make it extremely hard for NASA officials to make sense of the information.

And the most important point, that the foam had hit the heat shield at a force far beyond anything that had ever been tested, was in a tiny font at the end.

Presentation expert Joachim Lasoen created two simplified slides, based on the original text heavy NASA one, and these are shown below. Simplification has made the information much easier to understand. We’ll never know if the NASA officials would have made a different (and better) decision had they had clearer information, but it definitely wouldn’t have hurt.

Money and Simplicity

I’ve met and read about many financially successful and high earning people who think that financial complexity is something that comes with wealth.

There is the allure of the complex tax ‘scheme’ that no one understands, but which sounds like it’s too good to miss. A great example is the contractor loan schemes that have been in the news recently. These offered, for a hefty fee, to pay workers (such as freelance social workers, IT professionals, engineers and even nurses), by way of tax-free loans. Many of the users of these schemes are now facing bankruptcy as HM Revenue & Customs demands payment of back taxes.

Then there are hedge funds. Bernie Madoff ran an invitation only investment fund for wealthy investors and institutions and for years he produced market beating double digit returns. It all came on top in 2008 when it turned out that he had been running his funds as a Ponzi scheme since at least the early 1990s. Using new money to repay earlier investors worked fine until eventually more people wanted their money back than was being added to his funds. By the time Madoff was found out in 2008, it was estimated that losses to investors amounted to over $18 billion.

Only a few months before Madoff was found out, high profile financial ‘superwoman’ Nicola Horlick was singing his praises, with 10% of her investors’ £200 million invested with the conman. Despite having no idea how Madoff managed to make such abnormal returns, common sense suggesting something wasn’t right, and her supposed greater financial acumen, Horlick had blind faith in a fraudster. Had she just been using her own money it would have been funny. But the fact that she was punting with her clients’ money, and their life plans, made it unconscionable.

Had she just been using her own money it would have been funny. But the fact that she was punting with her clients’ money, and their life plans, made it unconscionable.

And then there is the allure of ‘active’ investment management, or in plain English ‘Pay us a premium in fees, for the very small possibility (<20%) that we might deliver a higher risk-adjusted return than just investing in the relevant low cost index fund.’

Fees are certain and paid every year and they have a massive impact on the value of your money over the very long-term. Investment returns are not certain. Given a choice of capturing most of the returns from a diversified basket of companies via a broad equity index fund, or an 80%+ chance of significantly underperforming that index fund, I know where I want my money.[i]

Life isn’t simple and we all face uncertainty and complexity. But the more you can simplify your financial life, the more likely it is that you’ll worry less, achieve more and avoid big blow ups.

So, when it comes to your money remember KISS, keep it simple, stupid.

Warm regards,

Jason

[i] I hold the bulk of my long-term portfolio in Vanguard Life Strategy 80. My daughters’ portfolios are held mainly in Vanguard Life Strategy 100 .